While known internationally as a popular European destination, Disneyland Resort Paris has been bogged down by debt and lackluster financial results since its opening in 1992. This week, however, Time Business revealed that the Walt Disney Company may be working to relieve these financial troubles through a buyout of the French company that manages the resort, Euro Disney SCA.

While known internationally as a popular European destination, Disneyland Resort Paris has been bogged down by debt and lackluster financial results since its opening in 1992. This week, however, Time Business revealed that the Walt Disney Company may be working to relieve these financial troubles through a buyout of the French company that manages the resort, Euro Disney SCA.

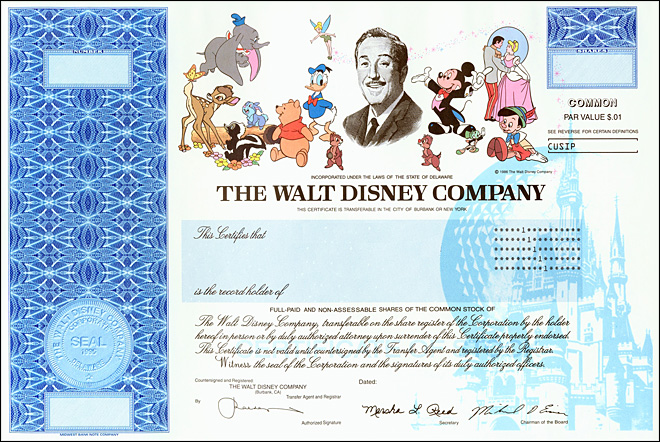

Time reports that internal meetings are currently being held to decide if the Walt Disney Company should buy out the Euro Disney stock that it does not own; currently, Disney owns about 40% of the stock, with the rest owned by Saudi Prince al-Waleed bin Talal (10%) and various individual and institutional investors. Market share for the remaining 23.4 million shares would be approximately $120 million, with Disney likely paying a significant premium over that price for the shares.

While Disneyland Paris attracts more than 15 million visitors each year, the resort has never been able to escape its financial troubles, with 12 out of the 20 years the resort has been open reporting net losses. As a result, Disney has had to reduce, waive, or defer the management fees and royalties that they were supposed to receive from the resort’s profits. However, Disneyland Paris has proven recently that things may be looking up, as the resort is finally making an operating profit thanks to higher guest spending coupled with management’s tight financial controls; in addition, hotel occupancy last year reached a near-historical high. As part of its 20th Anniversary celebration, Disneyland Paris recently debuted the incredible nighttime spectacular Disney Dreams and opened a new World of Disney store. In addition, the park has announced a multi-year expansion, and construction is currently underway on a major new attraction based on Disney/Pixar’s Ratatouille. The resort is currently on track to pay back one quarter of its debt remainder over the next six years, making this an opportune time for the Walt Disney Company to make a bid for the company.

If they do buyout Euro Disney SCA, Disney would increase their investment in the resort in order to add more attractions and pay down the debt more quickly. Disneyland Resort Paris currently consists of two parks, Disneyland Paris and Walt Disney Studios, but a Disney buyout could possibly lead to a third park being built between now and 2030 under a recently renewed agreement with the French state, who provided the land and public transportation and roads to the resort.

If it happens, this buyout could be extremely beneficial, not only for shareholders of Euro Disney SCA, but also for the millions of international Disney fans who would highly benefit from new attractions and operational improvements to this major tourist destination. Stay tuned for more news on this potential business decision.